I've spent the last rainy Melbourne week exploring AI and whether or not it could be usefull in trading.

This is something that I've attempted before, but given up as i didn't have the time. I still don't have the time, but I do have chatGPT what could go wrong !!!.

what could go wrong !!!.

My system/setup is :

- Visual Studio 2022.

- Python.

- TensorFlow (GPU Version).

- Norgate Data Platinum.

Last week I did set all this up and got everything working to run a simple test. WHY does setting up anything have to be soooo damn hard. NOTHING installed correctly, modules that should work didn't etc, trying to get the TensorFlow to use the GPU.... This was probably the hardest step of all and took over 2 days. ChatGPT was more useless than ever here.

was more useless than ever here.

This rainy week, I spent arguing with ChatGPT , but i initially managed to get a model built and trained on AAPL data. It was really only after i ditched chatGPT

, but i initially managed to get a model built and trained on AAPL data. It was really only after i ditched chatGPT and started exploring the code it gave me that i was finally able to build something that worked and could be expanded on.

and started exploring the code it gave me that i was finally able to build something that worked and could be expanded on.

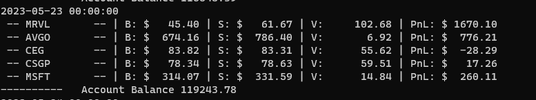

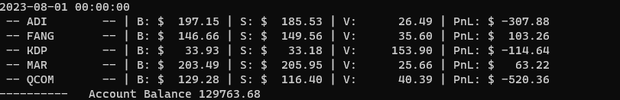

My initial testing is on the Nasdaq100. I have now trained a simple network on the Nasdaq100 from 2000 up until the start of 2021. My simple strategy was that the AI would buy the 5 best stocks and sell them in a week. SO, it had to pick the 5 stocks with the highest probability of the highest returns for 1 week and then sell. To get a reasonable sample it did this every day, ie every day it bought the 5 best stocks and sold them 5 days later, so on any given day it had 25 parcels.

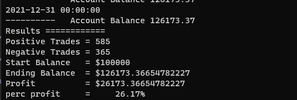

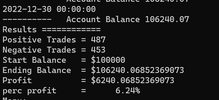

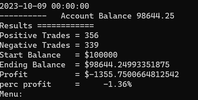

Here's the results of my latest Bot that i've run on the NDX for 2021 (ie, data it wasn't trained on).

- NDX Index UP 26%

- @Nick Radge TLT UP 13%

- AI Bot was UP 43% (with a number of anomalies, probably to do with the data importing or public holidays)

** Note i may have some delisted bias as i haven't incorporated that code yet, this is all still a test **

While i have NO definitive answer yet and the initial testing was mixed between encouraging and disheartening, the more i play the more i wonder if the Bot can trade better than me.

Time to switch off for the weekend.

This is something that I've attempted before, but given up as i didn't have the time. I still don't have the time, but I do have chatGPT

My system/setup is :

- Visual Studio 2022.

- Python.

- TensorFlow (GPU Version).

- Norgate Data Platinum.

Last week I did set all this up and got everything working to run a simple test. WHY does setting up anything have to be soooo damn hard. NOTHING installed correctly, modules that should work didn't etc, trying to get the TensorFlow to use the GPU.... This was probably the hardest step of all and took over 2 days. ChatGPT

This rainy week, I spent arguing with ChatGPT

and started exploring the code it gave me that i was finally able to build something that worked and could be expanded on.

and started exploring the code it gave me that i was finally able to build something that worked and could be expanded on.My initial testing is on the Nasdaq100. I have now trained a simple network on the Nasdaq100 from 2000 up until the start of 2021. My simple strategy was that the AI would buy the 5 best stocks and sell them in a week. SO, it had to pick the 5 stocks with the highest probability of the highest returns for 1 week and then sell. To get a reasonable sample it did this every day, ie every day it bought the 5 best stocks and sold them 5 days later, so on any given day it had 25 parcels.

Here's the results of my latest Bot that i've run on the NDX for 2021 (ie, data it wasn't trained on).

- NDX Index UP 26%

- @Nick Radge TLT UP 13%

- AI Bot was UP 43% (with a number of anomalies, probably to do with the data importing or public holidays)

** Note i may have some delisted bias as i haven't incorporated that code yet, this is all still a test **

While i have NO definitive answer yet and the initial testing was mixed between encouraging and disheartening, the more i play the more i wonder if the Bot can trade better than me.

Time to switch off for the weekend.