- Joined

- 15 June 2023

- Posts

- 1,233

- Reactions

- 2,721

Everyone is waiting for the interest rate to drop, here and in the US. I don't think you're going to see Aussie rates move until next year.

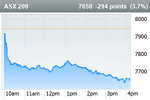

Australian shares lost more than 2% on Friday, wiping out all gains made over the past two sessions, after weak U.S. factory activity data sparked a global sell-off on worries of an economic hard landing.

The S&P/ASX 200 index XJO ended 2.1% lower at 7,943.20 points, their worst one-day drop since early March 2023. The benchmark had logged record closing highs in the last two sessions.

XJO ended 2.1% lower at 7,943.20 points, their worst one-day drop since early March 2023. The benchmark had logged record closing highs in the last two sessions.

A measure of U.S. manufacturing activity fell to an eight-month low, spooking investors and triggering a sell-off globally on worries that the economy could be headed for a hard landing.

Wall Street ended sharply lower overnight, while an MSCI gauge of Asia Pacific equities (.MIAP00000PUS) was down 3.5% as of 0622 GMT. Australian equities make up just over 10% of the MSCI index.

Australian shares had nowhere to go other than down given the heavy losses in the U.S. markets, said Tim Waterer, a market analyst at KCM Trade.

"There is also skepticism about whether (U.S.) rate cuts will arrive quick enough to stave off a potential economic hard landing," Waterer said.

He added that while local investors received some relief earlier in the week on softer local inflation data, "our market is not immune to steep sell-offs in the U.S.".

A volatility index for the Australian benchmark (.AXVI), an indicator of investor sentiment and market expectations, surged 14% to levels not seen since early May.

Domestic banks XFJ were the biggest weights on the local bourse, losing 2.6%, also slipping from a record high earlier in the week.

XFJ were the biggest weights on the local bourse, losing 2.6%, also slipping from a record high earlier in the week.

The "Big Four" banks shed between 1.4% and 4.1%. The index was down 0.2% for the week, snapping three straight weeks of gains.

Miners XXMM declined 1.4%, as Rio Tinto RIO and BHP Group

RIO and BHP Group  BHP slipped 0.7% and 1.5%, respectively.

BHP slipped 0.7% and 1.5%, respectively.

Technology XXIJ and energy stocks XEJ also lost over 2% each.

XEJ also lost over 2% each.

New Zealand's benchmark S&P/NZX 50 index NZ50G fell 0.3% to end the day at 12,453 points.

NZ50G fell 0.3% to end the day at 12,453 points.

Australian shares plunge on US economic hard landing concerns

Australian shares lost more than 2% on Friday, wiping out all gains made over the past two sessions, after weak U.S. factory activity data sparked a global sell-off on worries of an economic hard landing.

The S&P/ASX 200 index

A measure of U.S. manufacturing activity fell to an eight-month low, spooking investors and triggering a sell-off globally on worries that the economy could be headed for a hard landing.

Wall Street ended sharply lower overnight, while an MSCI gauge of Asia Pacific equities (.MIAP00000PUS) was down 3.5% as of 0622 GMT. Australian equities make up just over 10% of the MSCI index.

Australian shares had nowhere to go other than down given the heavy losses in the U.S. markets, said Tim Waterer, a market analyst at KCM Trade.

"There is also skepticism about whether (U.S.) rate cuts will arrive quick enough to stave off a potential economic hard landing," Waterer said.

He added that while local investors received some relief earlier in the week on softer local inflation data, "our market is not immune to steep sell-offs in the U.S.".

A volatility index for the Australian benchmark (.AXVI), an indicator of investor sentiment and market expectations, surged 14% to levels not seen since early May.

Domestic banks

The "Big Four" banks shed between 1.4% and 4.1%. The index was down 0.2% for the week, snapping three straight weeks of gains.

Miners XXMM declined 1.4%, as Rio Tinto

Technology XXIJ and energy stocks

New Zealand's benchmark S&P/NZX 50 index