tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,430

- Reactions

- 6,412

I see

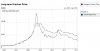

So it worked well from AUGUST.

In your vast experience then---when would be a time to take a long trade to take advantage of this "Divergence"

AUGUST?

NOW?

NEXT YEAR?

NEVER?

Why are you using a Money Flow Oscillator to trade off of divergence?

Can you explain the benefits from say a stochastic or perhaps an RSI or Williams %R?

)

)