Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,604

- Reactions

- 12,164

Ahem ..

"After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting." Jesse Livermore

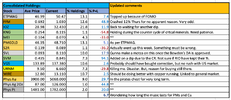

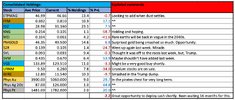

View attachment 196292

I agree, but super and cash are doing that for me. I need something to raise the blood pressure a little.