Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,134

- Reactions

- 11,246

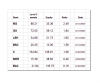

Dhukka, I defer to your undertanding of 'new money' but I have the impression, from a 'lay perspective', that there are institutions around the place with vaults full of cash, who are pumping money into the system. It is not 'new' money, but just other people's savings. So, it's only reducing the total savings that have been accumulated.Every week we hear the same crap from the media. This is just poor journalistic reporting. There were NO new injections of money pumped into the system, what the $47 billion injected by the Fed represents are rollovers of repos of different durations. Repeat there is no new liquidity being added to the system. John Hussman of Hussman Funds explains it best. Below relates last week's so-called massive injection of liquidity.

The developed world has a LOT of money in the bank to be distributed...

Maybe I'm way off track...