Dona Ferentes

BHINNEKATUNGGAL IKA

- Joined

- 11 January 2016

- Posts

- 17,375

- Reactions

- 23,783

and now that Friday / Monday have come and gone...There are seven ASX 200 shares that will be leaving the benchmark index when it rebalances on 24 March.

.....::'-::: . . .:. .:.:....,,,:::;:,'""'-.-:

$12b traded in seconds: Inside ASX’s record day

A quiet day when $20.3 billion of Australian shares changed hands? It is time to wake up.Fridays are normally quiet as fund managers head out to lunch – but not when they coincide with index changes..... Woolworths and Coles had good days after the ACCC’s supermarkets inquiry ended with a whimper, but Donald Trump didn’t announce anything new and it was a pretty average day with fund managers out to lunch and the ASX 200 up 0.2 per cent.

Yet at 4.10pm, as the ASX’s day-ending single price auction concluded and the market report was being written, huge lines of stock crossed screens.

There was a $436 million line of Commonwealth Bank, $399 million parcel of BHP, $240 million trade in Westpac, $237 million of Goodman Group, etc – about two dozen $200 million-plus trades according to Bloomberg data, all in large-cap names.

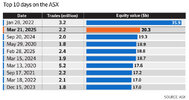

When the flurry finished, $20.3 billion worth of shares changed hands – the ASX’s second-biggest day ever by value of shares traded – including a record $11.8 billion in that frantic afternoon match.

A quiet day on the ASX? Hardly.

We need to rethink what constitutes a big day on the ASX. It is time to wake up if you think these trades do not impact share prices just because they happened in the match and just because share prices didn’t jump around on Friday (as seen by the market’s miserly 0.2 per cent gain).

It is all money moving and liquidity – a once-a-quarter peek inside the ASX liquidity casino. So, what really happened on Friday?

The S&P March quarter rebalance, which saw two additions and removals from both the ASX 50 and ASX 100 indices, and seven companies come and go from the ASX 200. This rebalance was especially big because of Chemist Warehouse buyer Sigma Healthcare’s seismic move from small caps into the top-50.

Index and index-aware funds bought nearly $1.5 billion of Chemist Warehouse shares late in the day, and sold smaller stakes in every other large cap to rebalance their portfolios to make sure they would mimic the index come Monday morning’s changeover.

The result was a whopper Friday on the ASX. A record-breaking day was more proof (in case we needed it) that index funds are a big part of the ASX and how Australian companies are valued.

That succession of 4.10pm trades was mostly done on the daily closing price – that’s how these big trades work. Brokers compile changes for the big index funds ahead of the changes, get the trades lined up via swaps and other derivatives, and then execute them on index day.

The result is a relatively smooth day’s trade given the known stampede that is guaranteed to happen on the match.

But that doesn’t mean index changes and preparation for the changes do not impact share prices – they do. The two companies that went into the ASX 50, Sigma Healthcare and Pro Medicus, had huge runs ahead of their inclusion, while the two that departed (Ramsay Health Care and Mineral Resources) were heavily sold.

Morgan Stanley’s Antony Conte says you can best see the price moves if you look at trading from the 20 days before index change announcements through to implementation. Conte, who looked at all ASX 200 rebalances since March 2007, found the average addition gained 6.4 per cent in that window, while the average removal dropped 6.2 per cent. If an investor was long the additions and short the removals, it could make 12.6 per cent excess returns on Conte’s numbers.

Of course, the trick is in accurately predicting the index changes. Brokers have always run the numbers, but fund managers are now taking notice. They can see the consequences in their own portfolios, and brokers are doing even more work promoting the trading strategies...

The trading – the numbers, the lines of stock – show how index funds have become a big part of the life on the ASX.

Is it a good thing for the ASX? We could debate that until the cows come home.

What you cannot debate is that these index days will continue to break records for the value of shares traded – you can be almost guaranteed. That’s when index funds (which brokers estimate to be as much as 30 per cent of the ASX 200) get active.