JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,476

- Reactions

- 6,540

Some great explanations of what may be happening out in the real world, away from governments and reserve banks -

@mullokintyre It will be interesting to see if the other banks are in the same thought bubble as Citi.CITI Bank have released their rate forecasts,

I wonder what they see happening starting in September.

View attachment 180194

Mick

Somewhat ominous given the choice of month does have a bit of a reputation.I wonder what they see happening starting in September.

Demand for US Treasury bonds dries up due to a loss of confidence and the Fed steps in?I wonder what they see happening starting in September.

dreaming of a rate cut , perhapsCITI Bank have released their rate forecasts,

I wonder what they see happening starting in September.

View attachment 180194

Mick

the exists for the benefit of the Major US banks, they are the ones who own it.dreaming of a rate cut , perhaps

or maybe they figure the Fed will try to buy an election

Crazy how low the saving accounts return as stated above...the exists for the benefit of the Major US banks, they are the ones who own it.

Go have a look at the activity that occupies the minds of the Fed banking system.

Pretty much everything they do is geared around making sure the big banks make a motza.

From Wall Street on Parade

View attachment 180196

View attachment 180197

Mick

Perhaps one of the reasons why CITI expect (hope?) there will be rate cuts can be seen in the following chart.CITI Bank have released their rate forecasts,

I wonder what they see happening starting in September.

View attachment 180194

Mick

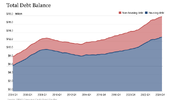

And don't the banks and credit suppliers love it.US consumers have resumed their use of revolving credit card debt, cruelling the narrative that at last US consumers were cutting back on spending.

View attachment 180293

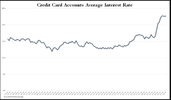

This comes despite the near record high Credit Card debt Interest sitting at 22.76%, 1 point below the all time high.

It is worth noting that over the years, credit card interest rates have been going up, but no matter the eceonomic conditons, they almost never go down.

View attachment 180294

Mick

And from Zero HedgeCox data shows repos jumped 23% in the first six months of this year compared with the same period in 2023. Repos started moving higher last year and have now exceeded pre-Covid levels, up 14% compared to the first half of 2019.

"When you think about the costs for rent and shelter and insurance, all those things hit consumers and they have to choose what they will pay," Jeremy Robb, senior director of economic and industry insights at Cox, told Bloomberg.

Robb warned, "More people are getting behind on payments because everything is more expensive."

Fitch Ratings data shows that the percentage of subprime auto borrowers who were at least 60 days late on their bill in June was around 5.62%, down from the record in February.

Data from Bankrate indicates that the average interest rate for a new 60-month auto loan is now 7.94%, while for a used car, it's around 12%. The average monthly payments have risen to $739 for new vehicles and $549 for used cars.

What's clear is that consumers have used more debt than ever to fund near-record new car purchases. Fast-forward to today and the ominous new development is that high monthly payments in a period of elevated inflation and high interest rates have made these vehicles unaffordable for some.

We believe this surge in nominal auto debt and elevated interest rates will crush the subprime borrowers as more fall behind on their car payments—a trend that should only accelerate.

Recently, Consumer Financial Protection Bureau officials have been concerned about troubling signs in the auto market, particularly among so-called subprime borrowers.

Now, it's a race against time for the Federal Reserve to provide relief to consumers. Traders are anticipating the first rate cut in September, driven by cooling inflation data.

Supply chain disruptions have become a major challenge for the global economy since the start of the COVID-19 pandemic. Assessing the intensity of these issues has also posed a challenge, as conventional measures tend to focus on specific dimensions of global supply chains.

Our goal in constructing the Global Supply Chain Pressure Index (GSCPI) was to develop a parsimonious measure of global supply chain pressures that could be used to gauge the importance of supply constraints with respect to economic outcomes. Our research indicates, for example, that changes in the GSCPI are associated with goods and producer price inflation in the United States and the euro area, both during the pandemic period and stretching back to 1997 (the starting point of our data set).

so i am guessing there is still a bottle-neck at the Panama CanalReinforcing the view that the US is headed for a period of stagflation, with a slowing economy and credit maxed out citizens, comes the news that supply chain pressure is mounting.

Firstly, the New York Fed has its say.

Goldman Sachs also sees its Global Supply Index rising for the first time in 2.5 years.

View attachment 180919

View attachment 180921

View attachment 180922

Mick

Plus the Houthis in the middle east contraing European trade.so i am guessing there is still a bottle-neck at the Panama Canal

surely it must be ( financially ) viable to ship from China to the US via the Pacific and then duck through the Panama Canal for goods destined for the US East Coast

interesting times

Finally, Australian culture is making an impact overseasUs homeowners, having spent all their savings (see post #73 ),maxed out their credit cards (see post #110 ), it now seems that they are turning to their home equity as an ATM.

From Zero Hedge

View attachment 182173

View attachment 182172

View attachment 182174

Mick

actually there are reports saying the IRS are letting more and more Americans dip into their IRAs and 401Ks ( the equivalent of their super funds/pension plans )Us homeowners, having spent all their savings (see post #73 ),maxed out their credit cards (see post #110 ), it now seems that they are turning to their home equity as an ATM.

From Zero Hedge

View attachment 182173

View attachment 182172

View attachment 182174

Mick

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.