professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

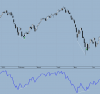

Re: Reversal Swing Convergence Divergence

just curious what the first and 3rd stock codes are tech?

just curious what the first and 3rd stock codes are tech?