- Joined

- 13 February 2006

- Posts

- 5,400

- Reactions

- 12,567

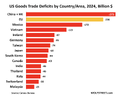

And so now, the US is on the clock: stocks down big means US consumer spending will be down soon. Which means US Federal receipts will begin falling soon. Tariffs up in theory raise revenue for the US government but only if:

- US trade partners (China) pay the tariffs effectively and;

- The USD rises to offset tariff-related inflation.

So tariffs are increasingly looking likely to be either or both an inflationary tax on consumers (stagflationary) or a pinch on corporate profits, leading to higher US unemployment, lower receipts and likely a US recession which typically sends deficits up 600-800 bps of GDP, or $1.6-2.2 trillion.

And so the US government is now in a race between the negative hit of all of the above against the ability to reshore and rebuild as fast as possible, with the blow maybe softened somewhat by tariffs.

So yields are currently falling driven by the run-to-safety trade that has always operated in the past during equity market sell-offs.

But the USD

Makes imports more expensive and then add the tariff effect to that also.

Inflation is, will be, higher. Thereby making UST yields incompatible with selling new debt, unless the Fed steps in to buy it.

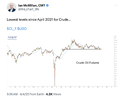

So oil:

Full:https://www.reuters.com/markets/com...new-challenges-top-oilfield-flags-2025-03-27/

The global shale market and economy cannot survive oil <$65 for long.

The UST market and global bond market cannot survive oil >$85 for long

So oil will have to be kept $65-85 range.

Gold will have to be allowed to be the release valve.

Since gold isn’t used for anything.

The gold/oil ratio, which just broke out is likely going to triple digits in coming years. Mostly via higher gold prices.

Oil News:

Friday, April 4th, 2025

The combined effect of Donald Trump’s import tariffs, OPEC+’s inopportune decision to speed up the unwinding of production cuts and China’s retaliatory actions have wiped off $10 per barrel from global oil prices, with ICE Brent falling below $65 per barrel for the first time since August 2021. Seeing backwardation barely change compared to the beginning of the week, one could assume that US tariffs are the defining factor for the price change, nevertheless this week will not go down well in the history of oil markets.

OPEC+ Rushes to Unwind Production Cuts. Eight OPEC+ countries that have been moving along with the gradual return of their 2.2 million b/d voluntary cuts unexpectedly agreed to expedite the unwinding of production cuts, boosting output in May by 411,000 b/d, equivalent to three monthly increases.

Trump Surprise Moves Squashes Metal Arbitrage. Whilst many traders expected Donald Trump’s import tariff roll-out to impact metal markets, the non-sanctioning of metals led to shrinking spreads between US and European benchmarks, with Comex gold premia over London futures halving to just $20 per ounce.

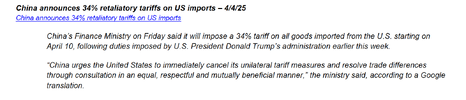

China Strikes Back with 34% Tariff Move. Reacting to President Trump’s sweeping tariffs, the Chinese Finance Ministry announced that it would impose additional tariffs of 34% on all goods produced in the US from April 10, concurrently adding seven rare earth minerals to Beijing’s export controls list.

Canada’s TMX Downgrades Export Outlook. Canada’s Trans Mountain pipeline has downgraded its outlook for 2026-2028, pushing out full utilization beyond 2028 with an expectation of 84% throughput this year, largely due to lower-than-expected spot bookings in TMX, a mere 18,500 b/d so far.

Nigeria Picks Shell Executive for Top Oil Post. Nigeria’s President Bola Tinubu appointed Bashir Bayo Ojulari, formerly the country manager of Shell’s (LON:SHEL)operations, as the top executive of the country’s national oil firm NNPC, just weeks before NNPC’s long-anticipated IPO.

Activist Investor Buys Up BP, Shorts Shell. US activist hedge fund Elliott Management, concurrently to its reforming drive in embattled oil major BP (NYSE:BP),has built up a huge short position in BP’s competitor Shell (LON:SHEL), equivalent to about 0.5% of Shell’s total worth.

IMF Warns of Global Tariff Fallout. The International Monetary Fund warned that US import tariffs and reciprocal measures triggered by them pose a ‘significant risk’ to the health of the global economy, potentially indicating that its 3.3% global GDP growth forecast for 2025-2026 could be soon cut lower.

World’s Top Miner Mulls Coal Spin-Off. Australia’s mining giant BHP (ASX:BHP) has reportedly considered spinning off its iron ore and coal divisions, similar to its previous listing of South32 in 2015, however, the company’s top management as iron ore still accounts for roughly 60% of its profits.

Agricultural Staples Fall Under Trade War Pressure. China’s reciprocal tariffs on the US have triggered a collapse in Chicago wheat and soybean futures as the tariff war puts US exporters at a disadvantage to Brazil, with both commodities set for their biggest weekly drop since November 2024.

Colombia Overcomes Indigenous Oil Riots. Ecopetrol (NYSE:EC), the national oil firm of Colombia, resumed operations at its Rubiales and Cano Sur oil fields, producing 140,000 b/d or 18% of the country’s total output, after a deal with Indigenous associations after weeks of riots that debilitated operations.

Iraq Doesn’t Want To Give Up on Kurdistan. The Iraqi Oil Ministry has reactivatedefforts to find a negotiated settlement with the semi-autonomous region of Kurdistan to resume oil exports from the north of the country, previously failing to convince Erbil that $16 per barrel would be an adequate price.

Kazakhstan Reports Giant Rare Earth Discovery. Kazakhstan’s Industry Ministry announced the discovery of a rare earth metal deposit with an estimated resource tally of more than 20 million tonnes in the region of Karaganda, placing it behind only China and Brazil in terms of prospective resources.

European Gas Stocks Plunge to Three-Year Lows. Natural gas stocks held in EU jurisdictions entered the summer period at their lowest in three years, totalling only 388 TWh of 34% of nameplate storage capacity, aggravated by a speeding up in net withdrawals to 1.02 TWh/d in the second half of March.

Ukraine war:

From NYT:

The Secret History of the War in Ukraine

This is the untold story of America’s hidden role in Ukrainian military operations against Russia’s invading armies.

"The US cannot credibly project conventional power against a near-peer or peer power to stop them from making changes to the global Rules Based Global Order. without taking politically-unacceptable levels of US casualties and Russia and China both know this. So systemic change to the 'Rules Based Global Order' is likely to continue at an accelerating pace."

So forcing Russia and China to term out future UST issues is not going to happen. Forcing China to unilaterally accept tariffs is not going to happen.

Trading this week:

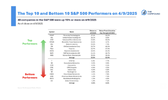

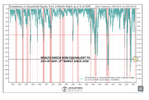

- Today was even worse than yesterday, with the S&P 500 dropping nearly -6%. The index has shed -10.5% over the past two sessions, marking its worst back-to-back decline since March 2020.

- Dean points out that declines of this magnitude are extremely rare within two months of a record high. This has only been observed during some of the worst stock market crashes in history, including 1929, 1987, and 2020.

- It would be foolish to draw a bold conclusion from a sample size of three. That said, $SPX has historically struggled over the next week, but six-month returns have never been negative.

The above chart is uncanny.

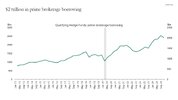

Fundamentally, yes stocks could fall a whole lot more quite easily. The main reason being that Trump in his many policy releases has targeted the capital flows as being an issue in the deficits. Markets have lost +/- $2 trillion in market cap. this week out of a $21 trillion foreign capital flow. Lots to go.

The Fed is sitting on its hands. Largely because things are likely to become significantly worse on the inflation and employment fronts and that will be soon. The ISM manufacturing data was horrible.

I have to say as 'tops' go, this has been a really fast one and hard to navigate. Being constantly hedged has been very rewarding this last couple of weeks.

Anyway, over the next few weeks my day job workload is lighter, so I will be able to update more regularly again.

jog on

duc