- Joined

- 13 February 2006

- Posts

- 5,222

- Reactions

- 11,990

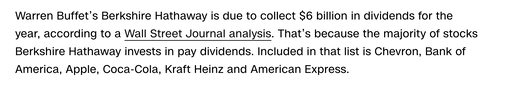

So let's start with the easy stuff:

Now we move into the more esoteric:

From yesterday's article re. the long basis trade (there is also a short basis trade).

In the Repo market you have securities that are termed 'General Collateral'. These are securities that are trading at their Par. If they trade at a premium or discount, they are called 'Specials'.

Part of the difference is allocated to 'Term Premium'. Other factors are: Cost of Balance Sheet, Transaction costs, Margin, Minimum Spreads, volatility spreads.

An OTR Treasury might have fixed supply of $50B. Short selling it can create an additional $10B (or more) of short positions. The actual supply is now $60B (but still only $50B of actual Bills/Notes/Bonds).

Cheapest-To-Deliver (CTD) Treasuries are used to settle Futures trade positions. They cannot fail.

The term premium is calculated in part, using historical data. So with the 2yr Note (which is forming the Hedge Fund trades currently) the overnight Repo rates from the entire 2yr history of previous issues will be calculated to provide the term premium. This can be (usually is) incorporated into the Futures price (among other variables).

In the Repo market, the actual securities do not calculate a term premium. They are more concerned with the volatility rate and other factors listed.

Part of the Repo rate is the chance of a fail rate. The fail rate is calculated from the General Collateral rate, for eg. at 2%. If the Repo is trading at 1.75% that is a 25% bps discount or an implied fail rate of 8%.

Short squeezes.

The players in the Repo market can implement a short squeeze. Primary Dealers, Banks, Broker-Dealers, Hedge Funds. When Short interest is high, the conditions are right for a short squeeze. Taking our example, the OTR issue of $50B now has an additional short interest of $50B = total positions = $100B

Then owners of the security, hold back their supply.

Cut to the Money Market Funds. Huge gobs of cash are being put (traded) into the Repo market. They have been cash buyers (lower leverage or zero leverage) of Treasury (and other) issues. If they hold back supply either purposely or inadvertently, they can create a short squeeze to the highly leveraged players. Volatility is a big issue.

Just got the MOVE index added:

Unfortunately only limited data currently. That may improve.

When bond market volatility rises, the potential for short squeezes and fails in CTD's also rises.

jog on

duc

Now we move into the more esoteric:

From yesterday's article re. the long basis trade (there is also a short basis trade).

In the Repo market you have securities that are termed 'General Collateral'. These are securities that are trading at their Par. If they trade at a premium or discount, they are called 'Specials'.

Part of the difference is allocated to 'Term Premium'. Other factors are: Cost of Balance Sheet, Transaction costs, Margin, Minimum Spreads, volatility spreads.

An OTR Treasury might have fixed supply of $50B. Short selling it can create an additional $10B (or more) of short positions. The actual supply is now $60B (but still only $50B of actual Bills/Notes/Bonds).

Cheapest-To-Deliver (CTD) Treasuries are used to settle Futures trade positions. They cannot fail.

The term premium is calculated in part, using historical data. So with the 2yr Note (which is forming the Hedge Fund trades currently) the overnight Repo rates from the entire 2yr history of previous issues will be calculated to provide the term premium. This can be (usually is) incorporated into the Futures price (among other variables).

In the Repo market, the actual securities do not calculate a term premium. They are more concerned with the volatility rate and other factors listed.

Part of the Repo rate is the chance of a fail rate. The fail rate is calculated from the General Collateral rate, for eg. at 2%. If the Repo is trading at 1.75% that is a 25% bps discount or an implied fail rate of 8%.

Short squeezes.

The players in the Repo market can implement a short squeeze. Primary Dealers, Banks, Broker-Dealers, Hedge Funds. When Short interest is high, the conditions are right for a short squeeze. Taking our example, the OTR issue of $50B now has an additional short interest of $50B = total positions = $100B

Then owners of the security, hold back their supply.

Cut to the Money Market Funds. Huge gobs of cash are being put (traded) into the Repo market. They have been cash buyers (lower leverage or zero leverage) of Treasury (and other) issues. If they hold back supply either purposely or inadvertently, they can create a short squeeze to the highly leveraged players. Volatility is a big issue.

Just got the MOVE index added:

Unfortunately only limited data currently. That may improve.

When bond market volatility rises, the potential for short squeezes and fails in CTD's also rises.

jog on

duc