- Joined

- 8 June 2008

- Posts

- 13,132

- Reactions

- 19,323

Was just evaluating a local gold buyer/reseller..not my usual oneBonjour,

So you are in the market for 100M/oz or so?

jog on

duc

Was just evaluating a local gold buyer/reseller..not my usual oneBonjour,

So you are in the market for 100M/oz or so?

jog on

duc

I just did a quick calculation on compounding a return of 0.27% over 1 year just 5 days a week as Gold is traded, and were one to achieve this return on Gold each weekday one would just over double ones money from $1000 to $2021 in 12 months.Gold is up 0.81% in $USD and 0.27% in $AUD overnight in the markets via Kitco.com.

Trumps antics have caused a pause in the strengthening of the $USD, this is good for Gold though, so we cannot be always on the right side of the trade here in Australia.

gg

You don't hold it, you don't own it.

jog on

duc

I believe they do institutional as there was a kerfuffle with an entity in China where Perth Mint was accused of putting some impurities in to their ingots some years ago.Does Perth Mint do a lot of institutional gold or is it more retail?

When I turn up with my PMGOLD voucher will they cash it in for physical?

The rush for physical gold and silver is international in scope.In addition, we see nuggets like this from Korea: “The Korea Gold Exchange found its website overwhelmed by the influx of investors. As of 11:30 AM on Feb. 6, the waiting time to access the site was a staggering 5 hours and 20 minutes, with over 19,000 individuals queued online.

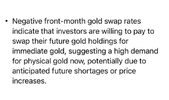

The stop-gap metal leasing tool used to cover-over the fact that there is only a miniscule amount of available gold and silver in comparison the hundreds of millions of ounces of gold claims and billions of ounces of silver claims standing in the cash/spot market, will be withdrawn.The critical path to market failure includes a realization by lessors of gold that, as gold (and silver prices) reset into higher orbits, market participants who have leased metal are not able to secure and return the leased metal due both to physical metal tightness as market leverage comes unwound but also - critically - lessee insolvency due to the liability of having to purchase metal for return to the lessor at far higher prices.

Just as aircraft can gently enter a ‘graveyard spiral’ or a ‘death spiral’ with everything seeming normal to the pilot at first but then quickly decaying into violent rotation downward, central bankers are going to gradually - then suddenly - recognize that much of the physical sovereign gold they have leased into the market for returns of pennies on the dollar will not be returned due to growing insolvency of those who have borrowed the metal.

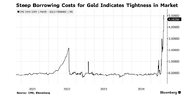

The LBMA frequently promotes the fact that London vaults hold approximately 280M oz. of gold and that the London gold market is highly liquid.While recognizing that there is more gold in transit, these data indicate that of the 16M oz. added to NY vaults since the beginning of December 2024, only 5.8M oz. or 36% came from London vaults.

Market data indicate that with an estimated 400M oz. or 12,440 tonnes of cash/spot contracts issued and standing in the London gold market, it took a draw-down of 5.8M oz. or 181 tonnes of gold from vaults to distress the London gold market.This indicates to us that the London gold market is not liquid and has had its vault stock of ‘free float’ gold, or the amount of the total liquid stock of gold that was actually available to market, desiccated to the point that the liquid gold stock in London now appears to be well dried-out.

The green portion of the graph below of London gold vault holdings represents the gold ‘float’ or the portion of London gold not held by the Bank of England or by ETFs and therefor potentially available to market.

The ‘free float’, which is the portion of the float that is actually available for sale into the market, appears to be wafer thin.

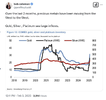

“Most importantly, the rush to buy metal is driven by non-bullion banks. So far just one week into the February gold contract, over 2 million oz has transferred from bullion banks to customer accounts. That exceeds the entire total for any prior contract by more than a factor of 3….

…Things to point out … the net buying by customer accounts on the February contract at over 2.0 million oz has exceeded any other contract in comex history by more than 3X. In addition, the largest net sell by non-bullion banks was only 2 contracts prior. This 2 month change is enormous. …

… So, we’ve just seen the largest change in direction of customer moving from a strong sell to a record buy. This plot suggests a huge buy signal. As of yesterday’s comex reports, the buying deluge continues. I’ll bring you updates in the days to come.

Forgot to mention … tariffs have nothing to do with this. This is all about customer accounts at comex thirsty for metal.”

indeed Mr. Duc.More Gold

Mr GG, you about to see gold up $100, $500 in a day.

jog on

duc

Mr GG, you about to see gold up $100, $500 in a day.

jog on

duc

@Sean K Meaning Gollie Locks ie POTUSPraise the Lord.

"early stages of a systemic crisis". Yikes.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.