over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,072

- Reactions

- 6,899

Would appear "steady as you go" would be aptGold, silver and the USD all fairly steady after some volatility around the time of the announcement. US market slightly up. A bit anti-climactic. The consenus seems to be that inflation is a little hot but is cooling and interest rates will likely pause instead of increase at the next FOMC meeting.

Calm has been restored. As you were.

So if you can't beat them, join them.Most (about 60%) of the inflation is due to the rising oil price with the deal between Russia and Saudi Arabia.

it won't just be the airlines that will be hurting, bowser prices aren't exactly going backwards.

Perhaps its time to look at an all electric harvester?Our fuel bill will be getting into serious territory with harvest just a few weeks away.

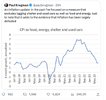

I read it that he is saying that those items are lagging indicators so this is an attempt to measure future inflation. That said, the choices seem strange, especially used cars and food! I can understand shelter.I have never been a fan of paul krugman, despite his many books, his professorship at New York Uni, and his Nobel Prize.

Especially when i saw this

View attachment 162519

So, excluding three of the biggest things that people on incomes significantly lower than Krugmans means that inflation is defeated.

For a lot of those people, there is precious little left after buying food, paying for elecytricity, oil or gas and then paying rent.

Lucky to to be too poor to have to worry about the inflated costs of vehicles.

Geez, talk about out of touch.

Mick

Supply curve simply moves upwards.I've been absent due to a new job, but couldn't stay away any longer now that petrol is $2.25/L in Sydney...

How long until this starts cutting into margins

Most unfortunately swings and round-a-bouts. About $2 odd here for petrol and $2.15 for diesel, At these prices is starting to bite.Supply curve simply moves upwards.

I have never been a fan of paul krugman, despite his many books, his professorship at New York Uni, and his Nobel Prize.

Especially when i saw this

View attachment 162519

So, excluding three of the biggest things that people on incomes significantly lower than Krugmans means that inflation is defeated.

For a lot of those people, there is precious little left after buying food, paying for elecytricity, oil or gas and then paying rent.

Lucky to to be too poor to have to worry about the inflated costs of vehicles.

Geez, talk about out of touch.

Mick

happily he is helping future economists to be as equally uselessI have never been a fan of paul krugman, despite his many books, his professorship at New York Uni, and his Nobel Prize.

Especially when i saw this

View attachment 162519

So, excluding three of the biggest things that people on incomes significantly lower than Krugmans means that inflation is defeated.

For a lot of those people, there is precious little left after buying food, paying for elecytricity, oil or gas and then paying rent.

Lucky to to be too poor to have to worry about the inflated costs of vehicles.

Geez, talk about out of touch.

Mick

somehow , i got the same impression , no wonder CPI figures are no longer taken as GospelHmmmm... I thought the whole idea of the CPI calculation was to weight the various components in accordance with the proportion of spending of income in relation to the various "sectors". I understand that he's attempting to gauge future inflation, but there's no guarantee that the sectors he's referring to will deflate in value either. According to the calculation of Australian CPI in 2022, he's devalued about half of the CPI components (housing 22%, food/non-alcoholic beverages 17%, transport 11%)...

Inflation and its Measurement | Explainer | Education

This series provides short, concise explanations for various economics topics.www.rba.gov.au

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.