- Joined

- 13 February 2006

- Posts

- 5,400

- Reactions

- 12,568

Politics:

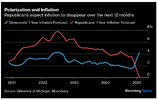

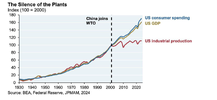

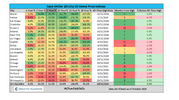

The big and broad tariffs promised by Trump could permanently shift trade norms that have shaped the global economy for decades.

Why it matters: Even if Trump-era trade wars recede, the effects might live on. Global leaders might follow the country's lead and weaponize tariffs more often to extract demands from trading partners.

What they're saying: Other countries are "coming to the conclusion that if the U.S. is willing and able to impose tariffs in an arbitrary way from a trade-law perspective, they can, too," Michael Froman, president of the Council on Foreign Relations and a former U.S. trade representative, tells Axios.

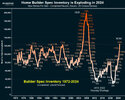

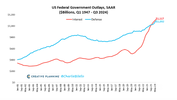

Another bubble in house prices.

Not really news, but worth watching if passive flows reverse.

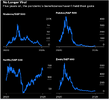

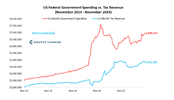

Now this (above) is critical:

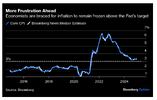

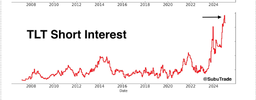

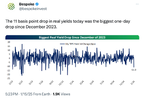

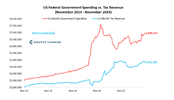

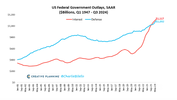

When the interest rate (10yr) is HIGHER than GDP growth and debt = 125% of GDP, you have a crisis as you will create a death spiral in the debt.

This needs lots of liquidity fast, ie. INFLATION.

This is the message of the high USD.

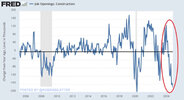

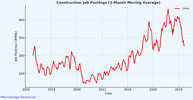

God forbid if unemployment moves into recession territory.

Markets are or were, celebrating a 0.1 downtick. Noise. The trend is in the wrong direction.

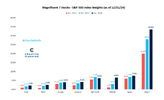

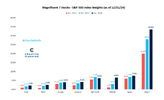

Mag 7 are holding the market lower. Everything else is pretty ok today.

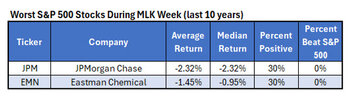

Banks are fairly solid ahead of earnings. I wouldn't expect any major shocks, the banks are simply too integral and important to allow any nasty surprises to be lurking. Of course they are pretty much bankrupt if they actually had to mark-to-market their UST holdings, but obviously they don't. LOL.

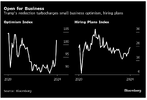

So assuming decent earnings, the market this week should at least consolidate. We have had our little shakeout and scare, now the market starts its inexorable march higher.

Don't get me wrong, this market is absolutely fu*ked, but not today.

Looks like a bit of a rotation going on. The XLY, XLK and XLC are the Mag 7 ETF's. So with the Mag 7 churning, exactly what you would expect to see.

jog on

duc

The big and broad tariffs promised by Trump could permanently shift trade norms that have shaped the global economy for decades.

Why it matters: Even if Trump-era trade wars recede, the effects might live on. Global leaders might follow the country's lead and weaponize tariffs more often to extract demands from trading partners.

What they're saying: Other countries are "coming to the conclusion that if the U.S. is willing and able to impose tariffs in an arbitrary way from a trade-law perspective, they can, too," Michael Froman, president of the Council on Foreign Relations and a former U.S. trade representative, tells Axios.

- "Every government around the world is under protectionist pressure," Froman adds. "They all have domestic interests and would rather not compete with imports from other other countries."

- The U.S. has increasingly imposed trade restrictions on the grounds of national security, invoking an exception to World Trade Organization rules. Other countries, including Mexico, have followed suit.

- "This used to be an exception that was rarely used. Now it is used more freely," Froman says.

- In a disruption scenario, Trump could declare a national economic emergency, which gives the president wide latitude over international economic policy.

- Then he could move quickly on tariffs. But he'd face blowback in the form of higher consumer prices, a slumping stock market, angry CEOs and congressional Republicans, retaliation from trade partners, and legal challenges.

- Canadian officials are already readying tariffs as high as 25% on nearly everything America sends to its neighbor to the north, Bloomberg first reported last week.

- "We are ready to respond with tariffs as necessary," outgoing Canadian Prime Minister Justin Trudeau told MSNBC this weekend.

- "We are the No. 1 export partner of about 35 different U.S. states," Trudeau added. "Anything that thickens the border between us ends up costing American citizens and American jobs."

- In 2018, countries hit back with tariffs that aimed to hit Trump where it would hurt: red-state economies that export products like soybeans and bourbon whiskey.

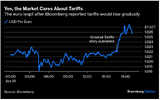

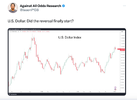

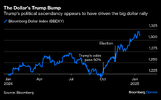

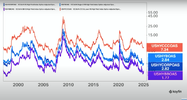

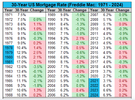

| It's the Dollar. This is the current headwind for equities around the globe, not just in the United States. I will say that I'm impressed with how well stocks and other risk assets have done despite the absolute ripper in the Dollar since last quarter. But there's only so much the stock market can withstand. Here's the U.S. Dollar Index breaking out to the highest levels since 2022. |

| Over the weekend, we went over all of the sector rotation and bullish characteristics that you regularly see during bull markets. And we're currently seeing many of these. The headwind, however, that is the U.S. Dollar remains in place. I still believe that it's going to take a Dollar rollover, for the next leg in this bull market to get going. Sector rotation is the lifeblood of a bull market. We've seen it this whole time. Can they step in and rotate them once again to get this party started? I think the Dollar will need to take a break. |

|

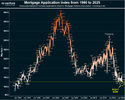

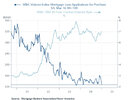

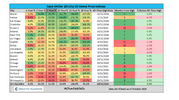

Another bubble in house prices.

Not really news, but worth watching if passive flows reverse.

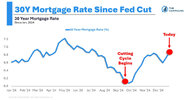

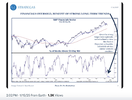

Now this (above) is critical:

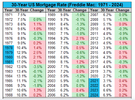

When the interest rate (10yr) is HIGHER than GDP growth and debt = 125% of GDP, you have a crisis as you will create a death spiral in the debt.

This needs lots of liquidity fast, ie. INFLATION.

This is the message of the high USD.

God forbid if unemployment moves into recession territory.

Markets are or were, celebrating a 0.1 downtick. Noise. The trend is in the wrong direction.

Mag 7 are holding the market lower. Everything else is pretty ok today.

Banks are fairly solid ahead of earnings. I wouldn't expect any major shocks, the banks are simply too integral and important to allow any nasty surprises to be lurking. Of course they are pretty much bankrupt if they actually had to mark-to-market their UST holdings, but obviously they don't. LOL.

So assuming decent earnings, the market this week should at least consolidate. We have had our little shakeout and scare, now the market starts its inexorable march higher.

Don't get me wrong, this market is absolutely fu*ked, but not today.

Looks like a bit of a rotation going on. The XLY, XLK and XLC are the Mag 7 ETF's. So with the Mag 7 churning, exactly what you would expect to see.

jog on

duc