DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 893

- Reactions

- 2,120

Market Index info@marketindex.com.au ………….. Today's News 6/4/23.

Move over lithium - A new battery technology wants to change the game…….

CERENERGY Battery Project: An alternative salt nickel battery that does not require any lithium for grid storage……..

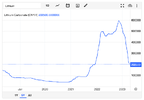

LYC's ADR's have dropped from abt US$7.00 to US$4.00 so far this year, ATC's plans prob explains that pullback, I can't imagine how much further it could fall in the ST.... Any TA atm is prob pretty useless..... maybe after the dust settles the worlds experts will come up with a call on the likes of LYC.....

Not sure where the LYC SP will eventually land - prob depends on what, if any, contingency plans Lithium Co's have made, as they all knew what was comming.....

I did try to warn everybody abt REE's in early 2022.....

ATC is only one of the many threats to the Lithium Industry...

Cheers....

DrB

Move over lithium - A new battery technology wants to change the game…….

CERENERGY Battery Project: An alternative salt nickel battery that does not require any lithium for grid storage……..

LYC's ADR's have dropped from abt US$7.00 to US$4.00 so far this year, ATC's plans prob explains that pullback, I can't imagine how much further it could fall in the ST.... Any TA atm is prob pretty useless..... maybe after the dust settles the worlds experts will come up with a call on the likes of LYC.....

Not sure where the LYC SP will eventually land - prob depends on what, if any, contingency plans Lithium Co's have made, as they all knew what was comming.....

I did try to warn everybody abt REE's in early 2022.....

ATC is only one of the many threats to the Lithium Industry...

Cheers....

DrB

Last edited: