- Joined

- 3 July 2009

- Posts

- 28,167

- Reactions

- 25,403

Looks like Goldman Sachs agrees with us Wayne.They shoulda gone .5

Looks like Goldman Sachs agrees with us Wayne.They shoulda gone .5

Goldman Sachs, like the other big players, will only release statements that help them make money.Looks like Goldman Sachs agrees with us Wayne.

ASX flat; RBA rate at 4.85pc by Sep: Goldman

Stocks flat. Goldman Sachs raises RBA rate hike expectations

Goldman Sachs, like the other big players, will only release statements that help them make money.

They aint there to dispel truth or help out investors.

Morgan Stanley sees only one more rate hike.

Blackrock sees persistent inflation worldwide including OZ, as he thinks much of the inflation is structural.

i would take anything GS, MS or Blackrock make with a grain of salt.

They will be positioning themselves to make a few billion no matter what happens.

Mick

All those office workers who think that working from home is the way to go, will be finding themselves replaced by people working from home in India, but don't tell them. ?Phil Lowe gave a speech this morning and he had a slide which showed productivity at 2019 levels. It never recovered post-COVID. This is despite wages growth.

My interpretation was that we had too many workers not doing much at all. So either we trim the fat, or we get those workers on payroll to do more work. I would think the latter would lead to a supply glut and would be more harmful to business' bottom line, so the former is the reasonable option.

Wow I'm not with ANZ fortunately. It was bad enough when I had to deal with the out-sourcing that Telstra had. Their spoken English is not what I could understand most tims.Well it didn't take long for the above quote to be confirmed.

Ah the clever country. ?

From the article:

Australian banks amp up tech talent wars in India

The big four banks are expanding their back office footprint in India, citing a shortage of necessary technology talent in Australia.www.smh.com.au

If you’ve taken out a mortgage with ANZ Bank, there’s a decent chance some processing of the loan occurred in the fast-growing city of Bengaluru in India.

The banking giant has close to 8000 staff in the city, who work on everything from helping to process applications for some loans or credit cards, to developing payment platforms, to conducting checks on new business clients.

This is the same as what happened to blue collar workers back in the eighties, their jobs were exported to China. I don't recall much empathy from white collar workers at the time. I think this is called Karma.All those office workers who think that working from home is the way to go, will be finding themselves replaced by people working from home in India, but don't tell them. ?

I had to call the NAB about a security issue, and spoke to someone who was most likely Filipino.Wow I'm not with ANZ fortunately. It was bad enough when I had to deal with the out-sourcing that Telstra had. Their spoken English is not what I could understand most tims.

finished ?? i suspect not ..... unless there is a pivotal election in the wind , a by-election somewhere , perhapsRBA left rates on Hold.

No great surprise given the flak.

Have they finished??

Mick

Well Mick, I don't know and i guess the RBA are in my boat alsoRBA left rates on Hold.

No great surprise given the flak.

Have they finished??

Mick

These banks with el-cheapo loans ovr a long time frame are they in the same leauge as ours making massive profits or on the verge of going bust as interest rates rise.Inflation is the enemy of the people, not debt laden government.

People will rejoice at no more hike, but will be decimated financially in a decade of higher real inflation.

No plebe winner here in n Oz as we do not have much fixed rate loans..different in Europe or US where you could get 25y fixed at 2%...

Bingo...for them

Some might get bust but in France, home loan are fixed on 20 or 25y.These banks with el-cheapo loans ovr a long time frame are they in the same leauge as ours making massive profits or on the verge of going bust as interest rates rise.

Its in the Banks interest of course to convince people that interest rates will be falling "real soon now" so that they can lok in their costs but are free to increase the rates they charge on loans.We are almost certainly at the peak of the interest rate cycle and that means cash savings rates are going to start falling soon.

Act now if you want to lock in longer-term deals on term deposits.

In fact, the key rates which determine the rates offered on cash deposits are already falling. The benchmark 10-year government bond rate in Australia, which was over 4 per cent in July, has already dropped to around 3.8 per cent.

As money market rates slide, the banks and other finance providers will now be planning to introduce lower rates.

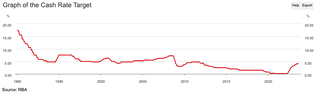

Savers and retirees who need dependable income streams have benefited from the 12 consecutive interest rate rises which brought us to an RBA cash rate of 4.1 per cent.

It’s almost the reverse of where we were in early 2021 when we hit the bottom of the rate cycle; that was the time to fix your mortgage.

We are now at the other end of the process and this is the time to “fix” cash deposit rates … and if it suits, do it for years.

For most active investors, bank-based term deposits continue to be the product of choice. That is because they are guaranteed to the tune of $250,000 per person per bank; they are quite literally risk free.

This government guarantee applies to all Approved Deposit-taking Institutions which can range well beyond the banks which are household names.

Financial advisers suggest the amount an investor may “fix” is at their own discretion, but also warn investors should check that deposit-taking groups are in fact ADIs. Finance companies offering term accounts paying 6 per cent or more might be lucrative to the investor, but they are not backed by a government guarantee.

Even assuming you are dealing with an approved ADI, such as a big four bank, it’s essential to read the fine print. Many of the advertised term deposit rates have strings attached, such as a high minimum level of cash upfront.

If we look at 3-year fixed term deposit rates, there is a 5.2 per cent rate from a leading bank but is requires a minimum of $25,000.

Among the big-four banks, at least $5000 is often required to access fixed 3-year rates near 4 per cent but the minimum can be lower if you go to a big-four subsidiary. Bank of Melbourne (a Westpac subsidiary) offers 4.05 per cent from $1000 upwards.

Moving beyond cash deposits, the likelihood that rates plateau and then drop from here will also be reflected in a range of related fixed-income products. Everything from bonds, private credit to bank hybrids will be repriced by the official cash rate moving lower.

Crestone Wealth Management chief investment officer Scott Haslem told clients in a recent note: “This may potentially be the last chance for those who do not have enough fixed income or high-yielding assets in their portfolios to lock in elevated returns for a number of years.”

Although most advisers and market economists believe the economic fundamentals suggest we are the top of the interest rate cycle, one more lift from the RBA is not impossible. But then again, advisers say it is always difficult to precisely pick the top of the cycle.

For active investors there are also a range of effects on the sharemarket and the property sector that need to be kept in mind once rate rises are over. With inflation moderating, the outlook for both shares and property will improve.

On the sharemarket we have just had a period where the income from cash and from shares were more or less the same – that is, the dividend yield on the ASX and the official cash rate were both just above 4 per cent. Share investing for income will now become more popular as cash returns start to diminish.

Similarly, in property the income from rentals – expressed as rental yields – hovers around 3 per cent in the major cities after expenses. When cash rates were better than property yields, investors held off buying property. Investors could now start returning to high-yielding investment property.

With the multi trillion dollar debt I guess the Govt is more than happy to squeeze every possible dollar out of the long suffering tax payers and those existing on Struggle Street.Maybe the Govt is happy, to milk the cow, rather than pull its ×!+$ off?

Why have a crash, when you can milk the extra gst, extra taxes on wages, profits, stamp duty on increased house prices.

All it does is reduce the buying power of savings and who cares about that? Lol

Because that's what we do these days, whinge until someone fixes your problem for you..Not sure why we are all whinging about rates.

Mick

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.