- Joined

- 30 June 2008

- Posts

- 15,811

- Reactions

- 7,658

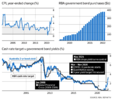

I think we are in unchartered waters at the moment. We have never had home loan rates under 2% - until last year. The average home loan is now $500k. Realistically it's probably more. If we suggest median wages are $80k then these $500 k loans are 6 times yearly earnings. That is historically very high.

However if interest rates do go up by 2% then we will see home loan rates around 4.6- 5% mark . This will double the loan repayments.

How will that scenario play out on stretched household budgets ?

It's all in the maths. A 2% interest hike on a 6% loan is effectively a 33% increase in repayments.

The same 2% increase on a current 2% loan is a 100% increase in repayments.

A 3% increase will result in a 150% increase in repayments

However if interest rates do go up by 2% then we will see home loan rates around 4.6- 5% mark . This will double the loan repayments.

How will that scenario play out on stretched household budgets ?

It's all in the maths. A 2% interest hike on a 6% loan is effectively a 33% increase in repayments.

The same 2% increase on a current 2% loan is a 100% increase in repayments.

A 3% increase will result in a 150% increase in repayments