- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

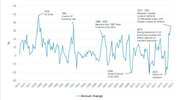

The RBA surprised markets with their decision yet again, seems like not many were expecting the cash rate to be lifted 0.5%.

Perhaps 50bps rate hikes are becoming the new norm with major central banks, in which case both AUD and the ASX200 may potentially be in for some repricing building up to the July meeting.

Perhaps 50bps rate hikes are becoming the new norm with major central banks, in which case both AUD and the ASX200 may potentially be in for some repricing building up to the July meeting.