Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,074

- Reactions

- 11,273

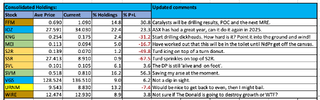

Two achievements today @Sean KI've decided to take some off the table until the dust settles with PMs. They've had such a huge run, I think there'll be some consolidation for a while. Silver looks like a false break out through $32.20 ish. And, I'm probably going to have egg on my face when they all run away to the moon.

Sold:

PDI +39%

ETPMAG +6.8%

PMGOLD +19.5%

GDX +39.3%

Gold and silver will go bananas now. Get on them!

- Peace of mind.

- A chance to get back in during what I hope is a consolidation in PM’s.