- Joined

- 25 December 2018

- Posts

- 258

- Reactions

- 232

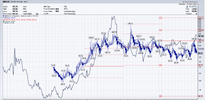

Crude Oil seems to be following a similar Curve to that of Gold so it will be interesting to observe the directional relationship between the two. Here is a Curve I posted on my website on Nov 16th calling Low which came out one day before the Forecast date followed by an advance into Nov 22nd where Top was indicated which has thus far pulled back from this point after an 8% move up