- Joined

- 23 April 2008

- Posts

- 1,856

- Reactions

- 632

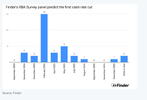

Free lunch on Monday, toss a coin on Tuesday.just in case you've missed it, RBA now has 2-day meetings, but only 9 times a year ... and not this coming Tuesday

2024 Reserve Bank Board meetings

- 5–6 February.

- 18–19 March.

- 6–7 May.

- 17–18 June.

- 5–6 August.

- 23–24 September.

- 4–5 November.

- 9–10 December