- Joined

- 27 April 2006

- Posts

- 523

- Reactions

- 1

visual said:see GP,this is the problem I have with charts

they seem to read the past flawlessly,why cant they say the same thing before it happens not after,cant be that difficult can it,

yep i`m raving

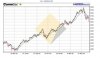

Very simple lesson in the chart posted just prier to your post ,by GreatPig

Notice the bubble in price above the top tread line

this is telling you that this is unsubstaniable and predicting a fall back between the two lines (normal trading range )

You must learn to hold your own counsol & not relly on others -- otherwise you are just following the sheep

this is a tremendouse learning oppurtunity -- learn from this so as to profit when the REAL bear hits !