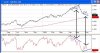

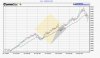

kennas said:The dead cat was 5000 back to 5100, now correction, consolidation. PEs must be looking very good now. No company downdgrades that I have seen. Should be all record reports again this year.

Agree

Actually OXR earnings was upgraded about 2 weeks ago and theres also been a few outperform calls since them, one from Goldmans and another from Citigroup

Zinc supplies are still running out, copper also very tight, fundamentals have not changed, and companies are still very profitable