Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,335

- Reactions

- 22,288

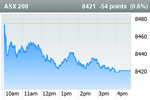

Evening Wrap: ASX 200 gains despite disturbing inflation report, gold and consumer stocks lead, uranium, lithium and coal stocks lag.

The S&P/ASX 200 closed 47.3 points higher, up 0.57%.

Evening Wrap: ASX 200 gains despite disturbing inflation report, gold and consumer stocks lead, uranium, lithium and coal stocks lag

There's plenty of news driving local stock prices at the moment, including the fallout from yesterday's announcement of the first round of President-elect Trump's new tariffs, as well as today's modest de-escalation of part of the conflict in the Middle East. On the first point, US stocks...