Dona Ferentes

beware the aedes of marsh

- Joined

- 11 January 2016

- Posts

- 16,846

- Reactions

- 23,005

starts a little laterIs it really this empty?

starts a little laterIs it really this empty?

Or asleep recovering from hungover or Xmas cricket injuriesI've got about 200 stocks on 20+ watchlists, and not one marked as sensitive️

... what a well-behaved ASX

ASX is kicking along alright this morning, everything I have is well into the green.I've got about 200 stocks on 20+ watchlists, and not one marked as sensitive️

... what a well-behaved ASX

well it is Dan Andrews's paradise ..Is it really this empty?

from memory not usually awash with bargains this time of year , but small ( boring ) illiquid stocks sometimes produceASX is kicking along alright this morning, everything I have is well into the green.

Not many bargains around at all.

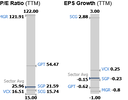

and yet GMG is widely favored by fund managers , are they mathematical klutzes or do they have a telescope into the future ?Peer Analysis

What is this?

Code:

View attachment 190158

Over the last 3 years, earnings at GMG have declined by an average of -- annually.This is worse than the industry average growth of -11.27%.

Morningstar data as of Friday, 27 December 2024

kind of bizarre , given the level of retail theft ( often called 'shrinkage' ) in the US ( and increasingly in Australia as well )Good morning divs. We can only work on what we know and try our best to assess and evaluate. Hopefully we get it right. Sometimes we do, sometimes not. We're winning if we get it right most of the time.

Consumer discretionary has had a very good run and pulled back about a week ago, divs. If you have a look at the sector, you'll see what I mean. Wouldn't hurt to keep an eye on this one?

most informative of you @Dona Ferentes ... and Happy New Year to you and family.Last day of 2024; shortened trading hours to 2pm..... ASX futures down 17 points or 0.2%

- AUD +0.1% to 62.24 US cents

- Bitcoin +1.1% to $US94,285

- Spot gold -0.6% to $US2606.02/oz

- Brent crude +0.3% to $US74.40 a barrel

- Iron ore +2% to $US100.85 a tonne

- 10-year yield: US 4.54% Australia 4.46% Germany 2.36%

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.