- Joined

- 8 June 2008

- Posts

- 13,639

- Reactions

- 20,307

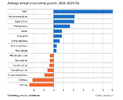

Not rosy reading but , from their ABC

www.abc.net.au

In summary, do we even have the expertise and know how to do more than cattle, grain and digging/shipping dirt?

www.abc.net.au

In summary, do we even have the expertise and know how to do more than cattle, grain and digging/shipping dirt?

Redflow was the great hope of Australian manufacturing. Its collapse left customers with broken batteries

Redflow had political backing and a soaring ambition to sell energy storage to the world, but its $10,000 batteries regularly failed within months of installation leaving customers out of pocket.